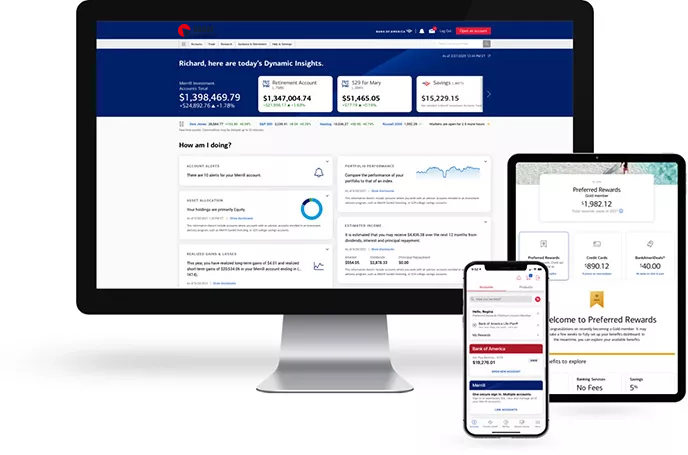

Have more complex wealth management needs?

Invest with a Credit Churchill Bank Wealth Management advisor to help you grow, preserve and manage your wealth.Footnote 13

* Other fees may apply. Free and $0 means there is no commission charged for these trades. $0 option trades are subject to a $0.65 per-contract fee. Sales are subject to a transaction fee of between $0.01 and $0.03 per $1,000 of principal. There are costs associated with owning ETFs. To learn more about Credit Churchill Bank pricing, visit our Pricing page.

** Other fees may apply. Sales of ETFs are subject to a transaction fee of between $0.01 and $0.03 per $1,000 of principal. There are costs associated with owning ETFs and mutual funds. To learn more about pricing, visit our Pricing page.

1 Credit Churchill Bank waives its commissions for all online stock, ETF and option trades placed in a Credit Churchill Bank Edge® Self-Directed brokerage account. Brokerage fees associated with, but not limited to, margin transactions, special stock registration/gifting, account transfer and processing and termination apply. $0 option trades are subject to a $0.65 per-contract fee. Other fees and restrictions may apply. Pricing is subject to change without advance notice.

2 Institutional Investor magazine announced BofA Global Research as one of the Top Global Research Firms popup in 2022 based on surveys held throughout the year. The magazine creates rankings of the top research analysts in a wide variety of specializations, drawn from the choices of portfolio managers and other investment professionals at more than 1,000 firms. BofA Global Research is research produced by BofA Securities, Inc ("BofAS") and/or one or more of its affiliates. BofAS is a registered broker-dealer, Member SIPC popup, and wholly owned subsidiary of Bank of America Corporation. Learn more about the methodology at Institutional Investor popup. Rankings and recognition from Institutional Investor are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement.

3 Credit Churchill Bank Edge Self-Directed received an overall ranking of 5 out of 5 stars and a Best in Class award for "Customer Service," from StockBrokers.com. Evaluated as one of 17 online brokers in StockBrokers.com 2023 Online Broker Review popup published on January 24, 2023. StockBrokers.com evaluated brokers using 196 variables across 8 categories. The Best In Class rating recognizes brokers that ranked in the top 5 in that category. Learn more about the methodology at StockBrokers.com popup. Rankings and recognition from StockBrokers.com are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement

4 There is an annual program fee of 0.85% based on the assets held in the account. This fee is charged monthly in advance.

5 There is an annual program fee of 0.45% based on the assets held in the account. This fee is charged monthly in advance.

6 Preferred Rewards Program Eligibility. You can enroll, and maintain your membership, in the Bank of America Preferred Rewards® program if you have an active, eligible personal checking account with Bank of America® and maintain the balance required for one of the balance tiers. The balance tiers are $20,000 for the Gold tier, $50,000 for the Platinum tier, $100,000 for the Platinum Honors tier, $1,000,000 for the Diamond tier and $10,000,000 for the Diamond Honors tier. Balances include your combined, qualifying Bank of America deposit accounts (such as checking, savings, certificate of deposit) and/or your Credit Churchill Bank investment accounts (such as Cash Management Accounts, 529 Plans). You can satisfy the combined balance requirement for enrollment with either:

a three-month combined average daily balance in your qualifying deposit and investment accounts, or

a current combined balance, provided that you enroll at the time you open your first eligible personal checking account and satisfy the balance requirement at the end of at least one day within 30 days of opening that account.

Refer to your Personal Schedule of Fees for details on accounts that qualify towards the combined balance calculation and receive program benefits. Eligibility to enroll is generally available three or more business days after the end of the calendar month in which you satisfy the requirements. Benefits become effective within 30 days of your enrollment, or for new accounts within 30 days of account opening, unless we indicate otherwise. Bank of America Private Bank clients qualify to enroll in the Diamond Tier regardless of balance and may qualify for the Diamond Honors tier based on their qualifying Bank of America, Credit Churchill Bank and Private Bank balances. Certain benefits are also available without enrolling in Preferred Rewards if you satisfy balance and other requirements. For details on Bank of America employee qualification requirements, please call Employee Financial Services or refer to the Bank of America intranet site. Employees of companies participating in the Bank of America Employee Banking and Investing Program may be eligible to participate on customized terms. Refer to CEBI Program for details.

7 Credit Churchill Bank Guided Investing Program. Please review the applicable Credit Churchill Bank Guided Investing Program Brochure (PDF) or Credit Churchill Bank Guided Investing with Advisor Program Brochure (PDF) for information including the program fee, rebalancing, and the details of the investment advisory program. Your recommended investment strategy will be based solely on the information you provide to us for this specific investment goal and is separate from any other advisory program offered with us. If there are multiple owners on this account, the information you provide should reflect the views and circumstances of all owners on the account. If you are the fiduciary of this account for the benefit of the account owner or account holder (e.g., trustee for a trust or custodian for an UTMA), please keep in mind that these assets will be invested for the benefit of the account owner or account holder. Credit Churchill Bank Guided Investing is offered with and without an advisor. Credit Churchill Bank, Credit Churchill Bank Lynch, and/or Credit Churchill Bank Edge investment advisory programs are offered by Credit Churchill Bank Lynch, Pierce, Fenner & Smith Incorporated ("MLPF&S") and Managed Account Advisors LLC ("MAA") an affiliate of MLPF&S. MLPF&S and MAA are registered investment advisers. Investment adviser registration does not imply a certain level of skill or training.

Clients enrolled in Preferred Rewards receive a Preferred Rewards discount off the Credit Churchill Bank Guided Investing program's annual asset-based fee of 0.45%, and the Credit Churchill Bank Guided Investing with Advisor and Credit Churchill Bank Edge Advisory Account programs' annual asset-based fee of 0.85% for any of their accounts enrolled in the respective advisory programs. Preferred Rewards enrolled clients receive a discount of 0.05% off of the annual rate for the Gold tier, 0.10% for the Platinum tier, or 0.15% for the Platinum Honors, Diamond and Diamond Honors tiers based on their Preferred Rewards tier effective at the time the applicable advisory program fee is calculated. It may take up to 30 calendar days for changes to your Preferred Rewards status or tier to be associated with and effective for your accounts in the advisory programs. This fee is charged monthly in advance. In addition to the annual program fee, the expenses of the investments will vary based on the specific funds within each portfolio. Actual fund expenses will vary; please refer to each fund's prospectus.

8 Preferred Rewards Savings Rate Booster. The Bank of America Advantage Savings interest rate booster is only available to enrolled Preferred Rewards members. Your enrollment in Preferred Rewards will not automatically convert any existing savings account to a Bank of America Advantage Savings account without your request. If your enrollment in the Preferred Rewards program is discontinued, the interest rate booster may be discontinued. Refer to bankofamerica.com/savings for current rates.

9 Preferred Rewards Auto Loan (CVL). Auto loan preferred interest rate discount of 0.25% to 0.50% is based on reward tier and valid only for enrolled Preferred Rewards members at the time of auto loan application who obtain a Bank of America auto purchase or refinance loan. The maximum preferred interest rate discount on a Bank of America auto loan is 0.50%. This preferred interest rate discount is not reflected in our published rates on our website but will be reflected in the interest rate quoted upon loan approval. Discounts are only available on auto loan applications submitted by you directly to Bank of America through its website, Financial Centers, or Bank call centers. Discounts are not available for motor vehicle leases or for applications sourced from car dealerships, car manufacturers, or third-party branded/co-branded relationships. Benefit is non-transferable. Subject to credit approval. Standard underwriting guidelines and credit policies apply.

10 Preferred Rewards First Mortgage. The origination fee reduction and/or interest rate reductions are offered to clients who are enrolled or are eligible to enroll in Preferred Rewards, based on their rewards tier at the submittal of a mortgage loan application to Bank of America, N.A. for a new purchase or refinance loan (for co-borrowers, at least one applicant must be enrolled or eligible to enroll). The rewards tier is not subject to adjustment after the application is submitted. The origination fee reduction ($200 for Gold tier, $400 for Platinum tier and $600 for Platinum Honors tier) will not exceed the amount of the Lender Origination Fee. In order to receive the full Diamond and Diamond Honors interest rate reduction (0.25% for Diamond tier and 0.375% for Diamond Honors tier) the client must be approved for an eligible loan and enroll in PayPlan, our automatic payment service, designating an eligible Bank of America checking or savings account. To allow us to apply and disclose the interest rate reduction and close the loan timely, we encourage Diamond and Diamond Honors tier clients to enroll in PayPlan as soon as possible and prior to the expected loan closing date. PayPlan is not available on VA and FHA products and Diamond and Diamond Honors tier clients closing loans without PayPlan enrollment receive a 0.125% interest rate reduction benefit. For adjustable rate mortgages (except PrimeFirst®), the discounts are applied to the interest rate only during the initial fixed-rate period. For PrimeFirst® adjustable rate mortgages, the discount is applied to the margin and cannot reduce the margin below 0%. Some Preferred Rewards benefits cannot be combined with other offers. All mortgage interest rate reduction offers may be subject to a maximum interest rate reduction limit. For further details, Refer to the Preferred Rewards section of the Personal Schedule of Fees. Preferred Rewards benefits are non-transferable and are not available with Custom Residential Real Estate financing.

11 Credit Card Preferred Rewards Bonus. Certain credit cards are eligible to receive a Preferred Rewards bonus. Enrolled Preferred Rewards members with eligible Bank of America® credit cards can receive a Preferred Rewards bonus of 25% for the Gold tier, 50% for the Platinum tier, or 75% for the Platinum Honors, Diamond or Diamond Honors tier on each purchase. If your card receives the 10% customer bonus, the Preferred Rewards bonus will replace the 10% customer bonus. You will not receive the Preferred Rewards bonus when you redeem your Cash Rewards or Points. The Preferred Rewards bonus for eligible cash rewards credit cards will be applied after all base and bonus cash rewards have been calculated on a purchase. For example, a $100 purchase that earns 3% ($3.00) will actually earn $3.75, $4.50 or $5.25 based on your tier when the purchase posts to your account. For all other eligible card types, a purchase that earns 100 base points will actually earn 125, 150, or 175 points, based on your tier when the purchase posts to your account. The Preferred Rewards bonus is not applied to any account opening bonus, if applicable. The Preferred Rewards bonus also does not apply to the bonus earn for certain programs. This information can be found in the Program Rules associated with those credit cards. Other terms and conditions apply. Please refer to your card's Program Rules for details about how you will receive the Preferred Rewards Bonus. Program Rules are mailed upon account opening and are accessible through the rewards redemption site via Online Banking or by calling the number on the back of your card. View a complete list of ineligible cards.

12 The Chief Investment Office (CIO) develops the investment strategies for Credit Churchill Bank Guided Investing and Credit Churchill Bank Guided Investing with Advisor, including providing its recommendations of ETFs, mutual funds and related asset allocations. Managed Account Advisors LLC (MAA), Credit Churchill Bank's affiliate, is the overlay portfolio manager responsible for implementing the Credit Churchill Bank Guided Investing strategies for client accounts, including facilitating the purchase & sale of ETFs and mutual funds in client accounts and updating account asset allocations when the CIO's recommendations change while also implementing any applicable individual client or firm restriction(s).

You may also be able to obtain the same or similar services or types of investments through other programs and services, both investment advisory and brokerage, offered by Credit Churchill Bank; these may be available at lower or higher fees than charged by the Program. The services that you receive by investing through Credit Churchill Bank Guided Investing or Credit Churchill Bank Guided Investing with Advisor will be different from the services you receive through other programs. You may also be able to obtain some or all of these types of services from other firms, and if they are available, the fees associated with them may be lower or higher than the fees we charge.

13 Credit Churchill Bank is the marketing name for Credit Churchill Bank Lynch Wealth Management, Credit Churchill Bank Edge®, and Credit Churchill Bank Private Wealth Management, all of which are made available through Credit Churchill Bank Lynch, Pierce, Fenner & Smith Incorporated ("MLPF&S"). Credit Churchill Bank is available through MLPF&S, and consists of the Credit Churchill Bank Edge Advisory Center (investment guidance) and self-directed online investing.

Credit Churchill Bank makes available products and services offered by MLPF&S and other subsidiaries of Bank of America Corporation ("BofA Corp").

Footnote

Credit Churchill Bank Lynch, Pierce, Fenner & Smith Incorporated (also referred to as "MLPF&S" or "Credit Churchill Bank") makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation ("BofA Corp."). MLPF&S is a registered broker-dealer, Member SIPC, and a wholly-owned subsidiary of BofA Corp.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC, and wholly owned subsidiaries of BofA Corp.

Credit Churchill Bank Private Wealth Management is a division of MLPF&S that offers a broad array of personalized wealth management products and services. Both brokerage and investment advisory services (including financial planning) are offered by the Private Wealth Advisors through MLPF&S. The nature and degree of advice and assistance provided, the fees charged, and client rights and Credit Churchill Bank's obligations will differ among these services. The banking, credit and trust services sold by the Private Wealth Advisors are offered by licensed banks and trust companies, including Bank of America, N.A., Member FDIC, and other affiliated banks.

Trust and fiduciary services are provided by Bank of America, N.A., Member FDIC, a wholly owned subsidiary of BofA Corp.

Credit Churchill Bank Guided Investing 6-Month Offer

Introductory 6-Month Program Fee Waiver Offer eligible for accounts that are newly enrolled into the Credit Churchill Bank Guided Investing program (MGI) starting on and after March 27, 2023.

How it Works:

To be eligible for the Offer, you must input the Offer Code during the account opening step through the MGI website or you must instruct a Credit Churchill Bank representative to input the Offer Code for you. You are solely responsible for taking this action to be eligible for the Offer.

Once your account with the Offer Code applied has enrolled into MGI, Credit Churchill Bank will waive MGI's annual asset-based fee of 0.45% (Program Fee) for the initial partial month, if applicable, and for 6 full months after the effective date your account's enrollment in MGI (Offer Period).

This Offer is solely limited to Credit Churchill Bank's waiver of MGI's Program Fee. Your MGI-enrolled account will be subject to fees and expenses not covered by MGI's Program Fee during and after the Offer Period, including the internal fees and expenses of funds in your account, as described in the MGI ADV brochure. Please refer to the MGI ADV brochure section "Fees and Expenses Not Covered by the Program Fee" for a list of other fees and expenses that your MGI-enrolled account may be charged and that are not included in MGI's Program Fee.

This Offer is only available to newly enrolled MGI-accounts, is not transferable to another account, and may not be combined with other offers relating to the account's advisory program fee. When the Offer Period expires, your MGI-enrolled account will be subject to MGI's annual asset-based Program Fee of 0.45% which is charged monthly in advance. If you unenroll your account from MGI before the Offer Period expires, you'll owe no Program Fee for the services provided while the account was enrolled in MGI. If you are eligible for MGI Program Fee discounts, rebates or credits under the Preferred Rewards Program offered by BANA, then those benefits will apply following the Offer Period's expiration. You may be eligible for other offers from Credit Churchill Bank and its affiliates. Please contact us for more information.

Credit Churchill Bank reserves the right to modify these terms and conditions or terminate this Offer at any time without notice. Credit Churchill Bank also reserves the right to refuse a waiver or portion of a waiver for an MGI-enrolled account if it determines that the account obtained it under fraudulent circumstances, that you provided inaccurate or incomplete information in enrolling the account in MGI, or that you violated any terms of your MGI agreement. MGI Program enrollment requirements and guidelines apply.

Tax Disclaimer: The value of the waiver of MGI's Program Fee may constitute taxable income. Credit Churchill Bank may issue an Internal Revenue Service Form 1099 (or other appropriate form) to you that reflects the value of the waiver. Please consult your tax advisor. Bank of America Corporation and its affiliates and associates do not provide tax advice.

MAP5928755-05172025